The Buzz on Pkf Advisory Services

The Buzz on Pkf Advisory Services

Blog Article

Examine This Report on Pkf Advisory Services

Table of ContentsThe Only Guide for Pkf Advisory ServicesThe Single Strategy To Use For Pkf Advisory ServicesPkf Advisory Services Can Be Fun For EveryoneThe Ultimate Guide To Pkf Advisory ServicesPkf Advisory Services Can Be Fun For Everyone

The majority of people nowadays become aware that they can not rely upon the state for greater than the absolute basics. Planning for retirement is an intricate business, and there are various options offered. A monetary consultant will not only assist filter through the lots of rules and product alternatives and assist create a portfolio to increase your long-term leads.

Buying a house is among one of the most pricey decisions we make and the huge bulk people require a home mortgage. An economic consultant can conserve you thousands, particularly at times such as this. Not just can they seek the very best rates, they can assist you analyze sensible levels of borrowing, maximize your down payment, and might additionally find lending institutions that would or else not be offered to you.

All about Pkf Advisory Services

An economic adviser recognizes how items operate in various markets and will determine feasible drawbacks for you as well as the possible benefits, so that you can after that make an educated decision concerning where to spend. As soon as your threat and investment evaluations are full, the next step is to consider tax obligation; even the many fundamental review of your setting could help.

For a lot more challenging arrangements, it could imply moving assets to your spouse or kids to maximise their individual allowances rather - PKF Advisory Services. A monetary advisor will certainly always have your tax obligation setting in mind when making suggestions and point you in the right instructions even in complicated situations. Even when your investments have actually been established and are going to strategy, they must be monitored in situation market growths or abnormal events push them off program

They can evaluate their efficiency versus their peers, make sure that your property allotment does not end up being altered as markets fluctuate and assist you combine gains as the deadlines for your supreme objectives relocate closer. Money is a complicated topic and there is lots to take into consideration to secure it and take advantage of it.

A Biased View of Pkf Advisory Services

Utilizing a good monetary advisor can reduce through the hype to guide you in the right direction. Whether you need general, useful suggestions or a professional with specialized competence, you might find that in the lengthy term the cash you buy skilled recommendations will certainly be visit this website repaid sometimes over.

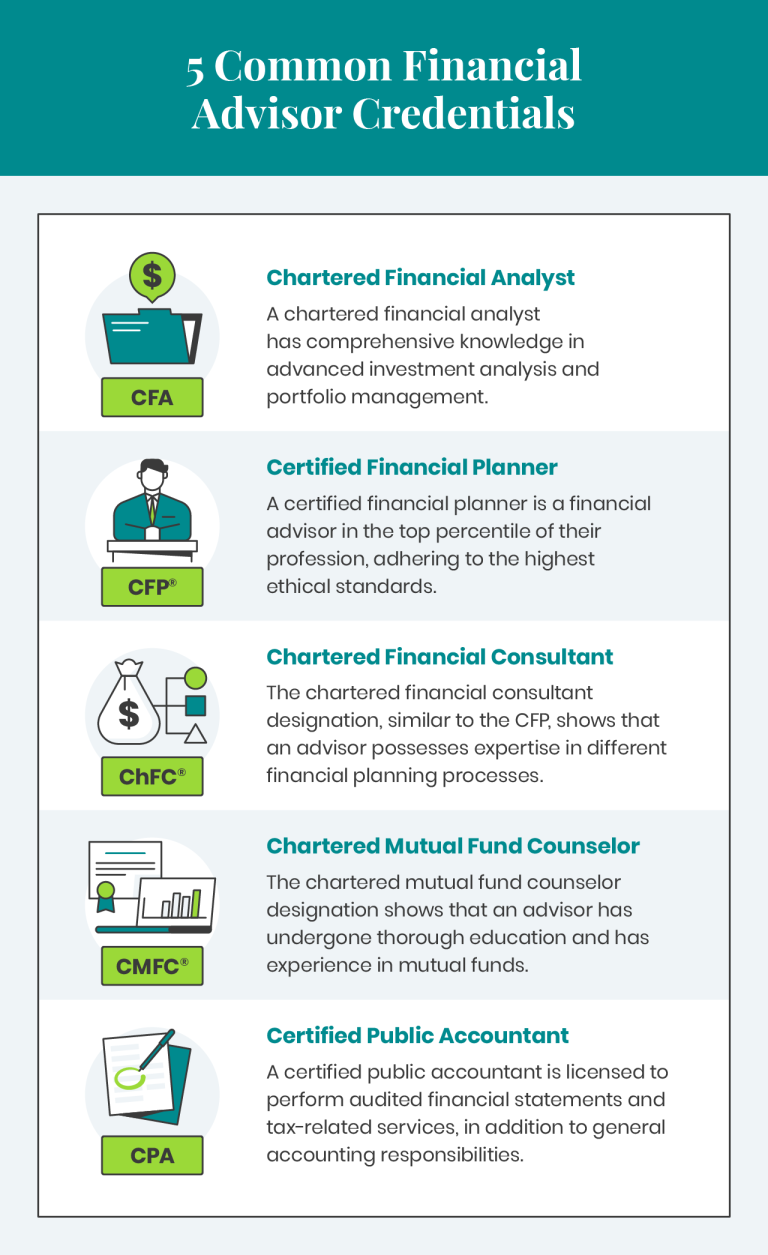

Keeping these licenses and qualifications needs continuous education and learning, which can be costly and time-consuming. Financial consultants need to remain updated with the most recent industry fads, guidelines, and best techniques to serve their clients efficiently. Despite these obstacles, being a qualified and qualified economic consultant provides immense advantages, consisting of numerous career opportunities and greater earning possibility.

How Pkf Advisory Services can Save You Time, Stress, and Money.

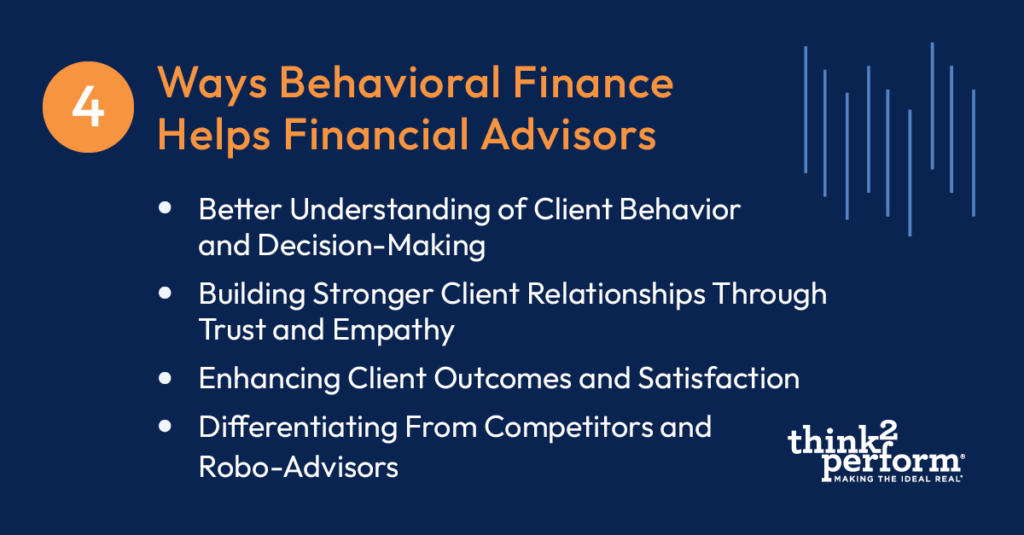

Financial consultants function carefully with customers from diverse histories, helping them navigate complex economic choices. The capacity to listen, recognize their special requirements, and give customized recommendations makes all the difference.

I began my career in corporate financing, moving and upward throughout the company money framework to refine skills that prepared me for the role I remain in today. My selection to relocate from business finance to individual money was driven by individual needs as well as the need to assist the lots of individuals, families, and local business I presently serve! Achieving a healthy and balanced work-life equilibrium can be challenging in the very early years of a monetary consultant's career.

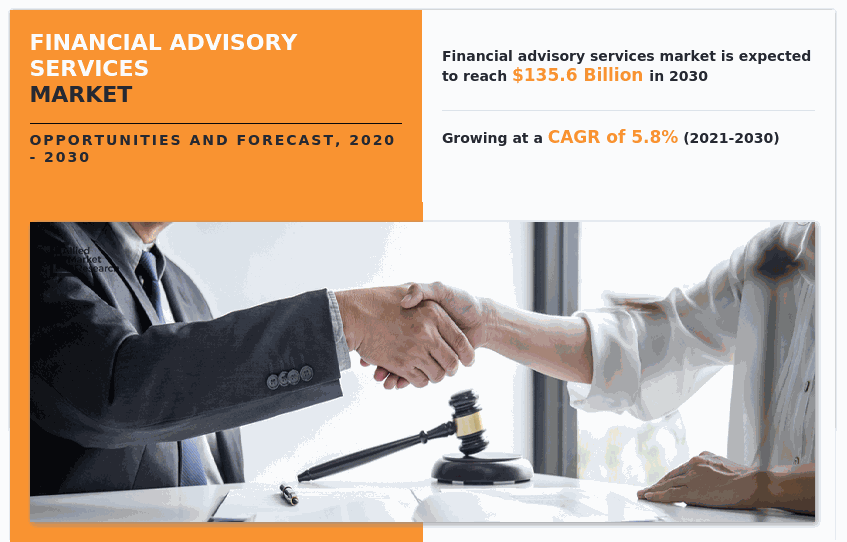

The economic advising occupation has a favorable expectation. It is expected to grow and advance constantly. The job market for individual monetary consultants is projected to expand by 17% from 2023 to 2033, showing solid demand for these solutions. This development is driven by factors such as a maturing populace requiring retired life preparation and enhanced understanding of the relevance of monetary planning.

Financial advisors have the unique capacity to make a substantial influence on their clients' lives, helping them accomplish their economic goals and protect Recommended Reading their futures. If you're passionate about finance and assisting others, this job path could be the best fit for you - PKF Advisory Services. To learn more info about ending up being a financial consultant, download our extensive frequently asked question sheet

Things about Pkf Advisory Services

If you would such as investment guidance regarding your details truths and situations, please get in touch with a qualified economic expert. Any type of investment involves some level of danger, and different kinds of investments involve differing levels of threat, consisting of loss of principal.

Previous performance of any kind of safety, indices, technique or allotment may not be a measure of future outcomes. The historical and current details regarding policies, laws, standards or advantages contained in this file is a recap of information acquired from or prepared by various other sources. It has not been individually confirmed, yet was obtained from resources believed to be trustworthy.

A financial advisor's most important asset is not expertise, experience, and even the ability to generate returns for customers. It's trust fund, the foundation of any type of effective advisor-client partnership. It establishes an advisor aside from the competitors and maintains customers returning. Financial specialists throughout the country we try this website interviewed agreed that count on is the crucial to constructing long-term, productive relationships with clients.

Report this page